Launch Your Caribbean Fintech Platform in Months, Not Years

Caribbean fintech startups waste 9+ months with offshore developers who don’t understand ECCB compliance or limited Stripe availability. Here’s how fintech platform Caribbean companies actually launch with proper regulatory compliance and regional payment integration.

The 9-Month Offshore Developer Disaster

Your offshore development team promised your neobank MVP in 3 months. It’s been 9 months. The WiPay integration still doesn’t work. Your runway is shrinking. Competitors are launching faster. Your Series A investors are asking uncomfortable questions about technical execution.

According to CB Insights, running out of cash is the #1 reason startups fail (38%). Every month of development delay burns $15,000 to $30,000 in operational costs while generating zero revenue.

Here’s what offshore developers don’t tell you: They’ve never built in the Caribbean. They don’t understand ECCB regulatory requirements. They’ve never integrated Caribbean payment processors. They’re learning Caribbean fintech reality on your dime and your timeline.

Why Caribbean Fintech Is Different

Mainland developers assume Stripe and PayPal work everywhere. They don’t in the Caribbean.

What Makes Caribbean Fintech Different

Regional Payment Processor Integration

You need WiPay (11 Caribbean territories), FirstAtlantic Commerce (24 Caribbean and Latin American countries), and Caribbean banking API integration.

Not “we’ll figure out Stripe alternatives later.”

ECCB Compliance for OECS Countries

Operating in Eastern Caribbean? The Eastern Caribbean Central Bank regulates digital financial services across 8 OECS member countries.

Your fintech platform Caribbean investors fund needs:

- ECCB regulatory compliance architecture from day one

- KYC/AML workflows meeting FATF standards

- Data protection meeting Caribbean requirements

- Transaction monitoring and reporting capabilities

Generic fintech platforms don’t include this. You’re retrofitting compliance into systems not designed for it.

Correspondent Banking De-Risking Reality

According to World Bank Caribbean remittance data, Caribbean financial institutions face ongoing correspondent banking relationship challenges.

This affects your platform’s:

- International wire transfer capabilities

- Cross-border payment processing

- Foreign currency settlement

- Banking partner integration options

Offshore developers don’t even know this is an issue.

Limited Stripe/PayPal Forcing Regional Solutions

Stripe is unavailable in most Caribbean countries. PayPal has limited functionality. Square doesn’t operate regionally.

Your options are:

- WiPay for Trinidad, Jamaica, Barbados, Guyana, and other territories

- FirstAtlantic Commerce for broader Caribbean coverage

- Direct Caribbean banking partnerships

- Regional payment network integration

Not hoping Stripe expands to your market eventually.

What We Build

Payment Processing Platforms: $35,000 to $55,000 | 10-14 weeks

Enable Caribbean businesses to accept payments regionally. Includes:

- WiPay and FirstAtlantic integration

- Real-time settlement tracking

- Fraud detection with Caribbean transaction patterns

- Multi-currency support (USD, Caribbean dollars, CAD)

- Chargeback management

- Merchant dashboards with Caribbean tax reporting

- API-first architecture for merchant integration

Best for: Payment processors, merchant services, regional payment networks

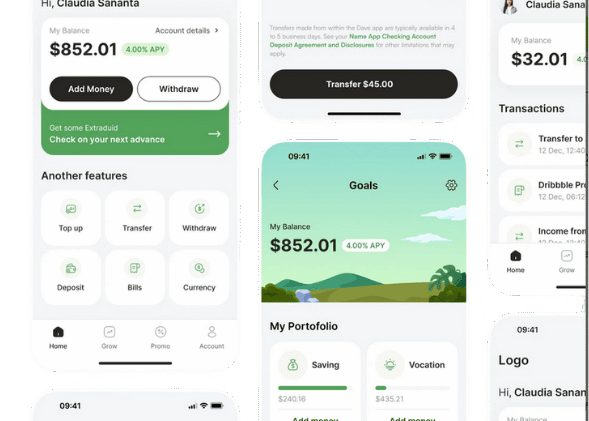

Neobank Platforms: $85,000 to $150,000 | 16-24 weeks

Digital-first banking for Caribbean consumers. Includes:

- Account opening with KYC/AML compliance

- Transaction processing and settlement

- Card management (virtual and physical)

- Peer-to-peer transfers

- Savings goals and spending analytics

- ECCB regulatory compliance (if operating in OECS)

- Integration with Caribbean Settlement Network

- Mobile-first interface (iOS and Android)

Best for: Digital banks, financial institutions, banking-as-a-service providers

Financial Management Apps: $45,000 to $75,000 | 12-16 weeks

Personal finance and business accounting for Caribbean users. Includes:

- Multi-island income tracking

- Caribbean tax considerations

- Currency conversion with realistic regional rates

- Remittance tracking for multi-island families

- Regional investment tracking

- Hurricane emergency fund planning

- Business expense management

Best for: Personal finance apps, SME accounting platforms, wealth management tools

How It Works

Week 1: 30-minute fintech assessment. We discuss regulatory requirements (ECCB vs individual island), target markets, payment processor needs, compliance timeline.

Weeks 1-3: Caribbean Fintech Framework setup. ECCB compliance architecture (if needed), KYC/AML workflows, Caribbean payment integration patterns configured.

Weeks 3-20: Development with 24-hour cycles. Complex fintech systems require more time than booking platforms. Weekly investor-ready progress demos.

Weeks 20-22: Regulatory compliance testing. ECCB requirement verification, penetration testing, security audits meeting institutional standards.

Week 22+: Staged launch with monitoring. Pilot users, full launch when metrics hit targets. Ongoing compliance support.

Real Results

Caribbean neobank startup, pre-seed funded, needed MVP for Series A.

16 weeks after kickoff:

- Fully functional neobank MVP launched

- ECCB compliance architecture implemented

- WiPay integration processing test transactions

- 200+ pilot users onboarded

- Investor demo-ready platform

- $95,000 investment (saved 6+ months vs offshore team)

They raised their Series A 3 months after launch. The working MVP was critical to investor confidence.

The Runway Math

Typical offshore scenario:

- Month 1-3: Learning Caribbean payment processors ($45,000 burned)

- Month 4-6: Discovering ECCB compliance requirements ($45,000 burned)

- Month 6-9: Retrofitting compliance, still not launched ($45,000 burned)

Total: 9 months, $135,000 operational burn, no revenue

Our approach:

- Months 1-4: Building with Caribbean compliance from day one ($60,000 dev cost + $60,000 operational)

- Month 4: Launched and generating revenue

Total: 4 months, $120,000 total spend, revenue generating

Difference: 5 months faster, $15,000 saved, but most importantly you’re live and validated with real users.

Why Offshore Teams Fail at Caribbean Fintech

They treat Caribbean fintech like any other market. It’s not.

They don’t understand:

- Month 1: Caribbean payment processor integration complexity

- Month 2: ECCB regulatory requirements existence

- Month 3: Correspondent banking de-risking impact

- Month 4: Limited Stripe/PayPal availability

- Month 5-9: Expensive retrofitting and timeline slips

We’re different: Bahamian-founded fintech focus. We’ve built Caribbean payment integration multiple times. ECCB compliance patterns are solved. Caribbean banking relationships established.

You get working, compliant fintech platform Caribbean investors fund in 12-20 weeks, not 12+ months.

What Investors Want to See

Before Series A, investors typically require:

✓ Working MVP with real users (not prototypes)

✓ Regulatory compliance path clearly defined

✓ Payment processing actually functional

✓ Security architecture meeting institutional standards

✓ Scalability plan for regional expansion

✓ Financial projections based on working platform data

Our platforms provide all of this. We’ve supported multiple fintech fundraises with investor-ready demos and compliance documentation.

Ready to Launch in Months, Not Years?

Book a free 30-minute Caribbean fintech assessment. We’ll discuss regulatory requirements, technical architecture, realistic timelines, and transparent pricing.

No pressure. No obligation. If we’re not the right fit for your stage or requirements, we’ll tell you.

The alternative: Spend 9+ months with offshore developers learning Caribbean fintech on your runway. Miss your launch window. Watch competitors capture your market. Run out of cash before finding product-market fit.

Or: Launch in 4-6 months with proper compliance. Get to revenue faster. Validate with real users. Raise your next round from a position of strength.

30-minute call. Zero pressure. Honest feedback about launching compliant Caribbean fintech platforms.